Market Entry Marketing

Market Entry Marketing for Vietnamese Companies Expanding International [2026]

Market entry marketing is becoming essential as Vietnamese companies expand internationally at record speed. Vietnam’s export engine surpassed USD 405 billion in 2024, showing that local firms are already embedded in global value chains. The next stage of growth, however, is not just about shipping products abroad but about building global demand for Vietnamese brands. This is where many expansions stall. While Vietnamese companies are often operationally strong, international expansion can still fail when buyers do not clearly understand the value, do not trust the brand, or do not see a reason to switch. This is precisely why structured market entry services emphasize demand creation, positioning, and validation before scale.

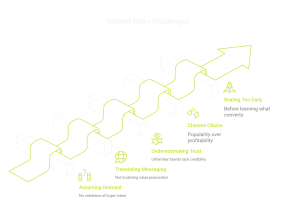

Why International Market Entry Often Fails for Vietnamese Companies

Most Vietnamese SMEs do not fail abroad because of poor execution or weak products. They fail because market-entry decisions are made on assumptions rather than evidence, a pattern explored in depth when examining why market entry fails even when the product is strong.

Common patterns include:

-

Assuming demand exists without validating buyer intent

-

Translating existing messaging instead of localizing value

-

Underestimating how much trust matters for unfamiliar brands

-

Choosing channels based on popularity, not profitability

-

Scaling too early, before learning what actually converts

In many cases, companies “launch” successfully but never reach sustainable demand. Costs rise, distributors lose interest, and internal confidence declines. Expansion quietly stalls. This pattern is precisely why market entry marketing should be treated as a system, not a campaign. It allows companies to replace assumptions with market signals before committing serious resources.

What Market Entry Marketing Means in Practice

Market entry marketing is not about running ads in another country. It is a structured process designed to create demand before scale by aligning strategy, positioning, channels, and proof with how buyers in the target market actually make decisions. For Vietnamese companies expanding abroad, market entry marketing focuses on five interconnected areas:

-

Validating real demand and willingness to pay

-

Adapting positioning to local buyer logic

-

Selecting channels that can reach buyers efficiently

-

Building trust and credibility early

-

Measuring performance to guide scaling decisions

When these elements work together, marketing becomes a decision-making tool rather than just a promotional activity.

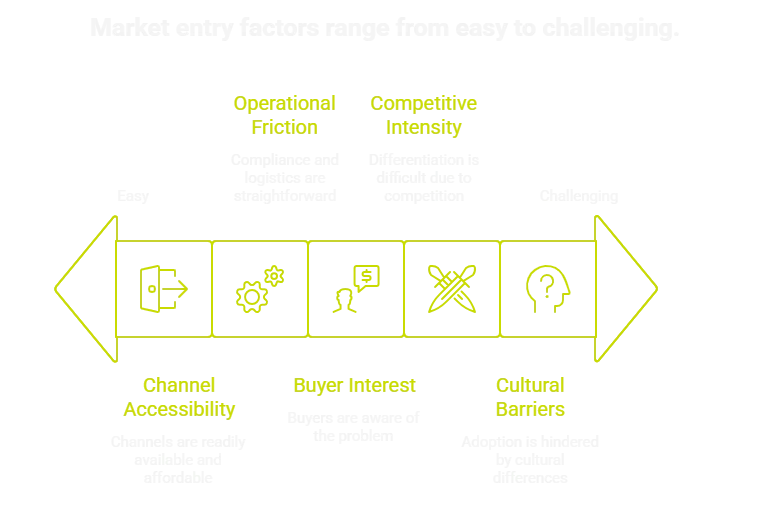

Market Selection With Commercial Reality in Mind

Effective market entry marketing starts with a narrower question: can we create demand profitably in this market, a challenge that sits at the core of market entry strategy and frameworks used to reduce risk before committing serious resources.

Practical screening criteria include:

-

Evidence of buyer interest or problem awareness

-

Competitive intensity and differentiation gaps

-

Channel accessibility and cost dynamics

-

Operational friction, such as compliance or logistics

-

Cultural or behavioral barriers to adoption

Instead of entering many markets at once, Vietnamese SMEs benefit from choosing one or two priority markets where demand signals are strongest, and learning can happen quickly.

Localization Is About Meaning, Not Language

One of the most common mistakes in international expansion is equating localization with translation. Translation changes words. Localization changes relevance. Buyers in foreign markets often evaluate products differently. They compare alternatives using local benchmarks, prioritize different benefits, and require different proof before committing. Messaging that works in Vietnam may feel unclear, exaggerated, or unconvincing abroad. Market entry marketing addresses this by reshaping positioning for the target market, a process that becomes critical when defining positioning and messaging that resonate with local buyers and their decision criteria.

Without this step, marketing spend tends to increase without improving conversion. Traffic arrives, but buyers hesitate.

Channel Strategy Based on Economics, Not Trends

Vietnam’s digital ecosystem is fast-growing and highly active, but digital markets behave very differently around the world. In 2025, global retail e-commerce sales are projected to reach about USD 6.42 trillion, accounting for roughly 20.5 % of total retail sales worldwide, reflecting how deeply online buying has become part of consumer behavior in some regions. In reality, channel dynamics change significantly from market to market: in some regions, search plays a dominant role; in others, marketplaces, retail partners, or industry platforms matter more. Paid media may validate demand quickly, but it can become expensive if positioning is weak, and distributors may accelerate reach while reducing control and margin. Market entry marketing evaluates channels through testing rather than assumptions. Early performance data reveals where demand actually forms, how long it takes to convert, and where costs escalate, helping companies avoid overinvestment in channels that look attractive but fail commercially.

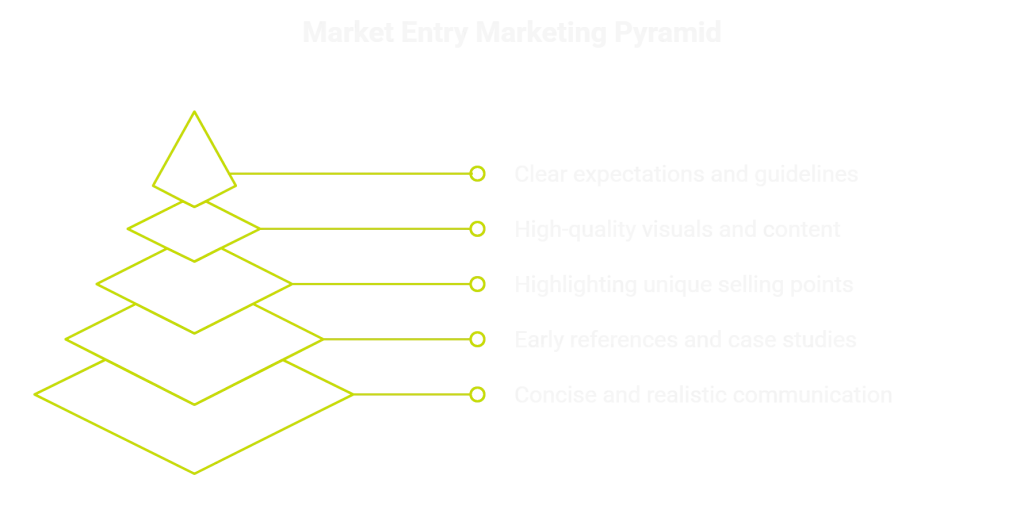

Trust Is the Hidden Barrier for Vietnamese Brands Abroad

For international buyers, unfamiliar brands represent risk. Even when price and features are competitive, buyers often default to known alternatives unless trust is established. Trust is not built through claims alone. It is built through consistency, proof, and professionalism. Market entry marketing prioritizes credibility from the beginning, using elements such as:

-

Clear and realistic messaging

-

Case snapshots or early references

-

Comparisons that clarify differentiation

-

Professional visual and content standards

-

Transparent policies and expectations

Without trust, conversion rates remain low regardless of traffic volume. Acquisition costs rise, and scaling becomes fragile. This is why market entry marketing is inseparable from brand building in new markets. The goal is not to look large, but to look reliable.

Validation Before Scale: The SME Advantage

Large corporations can afford long learning cycles. SMEs cannot. For Vietnamese companies expanding abroad, speed matters, but controlled speed matters more. Validation means testing before committing. It involves:

-

Targeted campaigns to measure real interest

-

Landing pages are designed to surface objections

-

Segment testing to identify best-fit buyers

-

Channel experiments to understand economics

The objective is clarity, not volume. By validating early, companies avoid entering markets that look promising but fail to deliver sustainable returns. This is where market entry marketing delivers measurable value. Even unsuccessful tests yield insights that inform better decisions.

A Practical Market Entry Marketing Plan

A structured approach helps Vietnamese SMEs expand abroad without overcommitting too early.

Phase 1: Direction and Foundations (First 30 Days)

-

Select a priority market based on demand signals

-

Define positioning for international buyers

-

Prepare proof and credibility assets

-

Build market-specific landing experiences

Phase 2: Validation and Learning (Days 30–60)

-

Run controlled marketing tests

-

Measure engagement, conversion, and objections

-

Refine messaging and offers

Phase 3: Scaling With Control (Days 60–90)

-

Focus on winning segments and channels

-

Improve conversion before increasing spend

-

Build repeatable acquisition systems

This process separates expansion driven by evidence from expansion driven by hope, and is typically supported through structured market entry marketing support that aligns strategy, validation, and execution.

![Market Entry Marketing for Vietnamese Companies Expanding Abroad [2026] - visual selection](https://stratikasolutions.com/wp-content/uploads/2026/01/Market-Entry-Marketing-for-Vietnamese-Companies-Expanding-Abroad-2026-visual-selection-1.webp)

Why Marketing Determines Success in International Expansion

Exporting moves products. Expansion creates demand. The difference is rarely operational strength. It is the ability to persuade buyers who have no prior relationship with the brand. Vietnamese companies already compete globally on cost, speed, and supply reliability. The next generation of international winners will compete in demand creation. They will validate markets before committing, build trust before pushing scale, and apply validation before scaling as a disciplined growth principle rather than a last-mile tactic. When marketing is treated this way, market entry stops being a gamble. Risk becomes manageable. Learning becomes systematic. Growth becomes deliberate and repeatable.

![Market Entry Marketing for Vietnamese Companies Expanding International [2026]](https://stratikasolutions.com/wp-content/uploads/2025/06/Market-Entry-Marketing-Cover-by-Stratika-Solutions-1-1170x547.webp)