Market Entry Services

Market Entry Services: From Strategy to Scalable Growth [2026 Edition]

Expanding into a new market isn’t just “selling abroad.” It’s stepping into a different reality: different buyer habits, different trust signals, different competitors (including substitutes), different channel costs, and different operational friction. That’s why market entry services exist, not to make expansion look professional, but to make it work commercially. At Stratika Solutions, we approach market entry as a systematic process. Not a launch. Not a translation job. Not a hopeful ad spend. A system that connects strategy → validation → go-to-market execution → performance → scale.

This guide explains what market entry services actually include, why expansion fails even with strong products, and how to structure entry so you build demand with control, not guesswork.

What Market Entry Services Really Mean

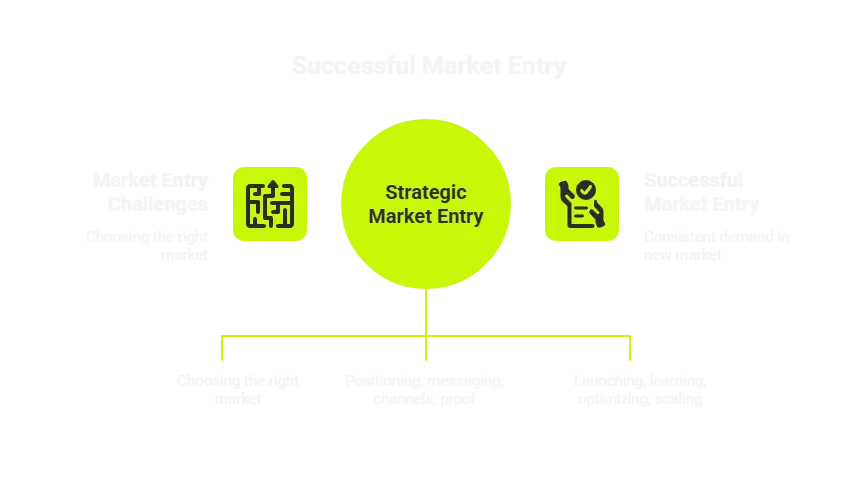

“Market entry services” should not mean a slide deck and a few generic recommendations. Real market entry services combine three things:

Decision structure(choosing the right market and entry approach)

Demand creation(positioning, messaging, channels, proof)

Execution and measurement(launching, learning, optimizing, scaling)

In other words, market entry services are the bridge between “We want to expand” and “We’re generating consistent demand in a new market.”

This is especially important for growing companies. Most SMEs don’t have a whole in-house team for research, brand strategy, performance marketing, conversion optimization, analytics, CRM, and local execution. So the risk isn’t just “wrong strategy.” The risk is fragmentation: different vendors pulling in various directions, with no single entity owning the outcomes.

Why Market Entry Fails Even When the Product Is Strong

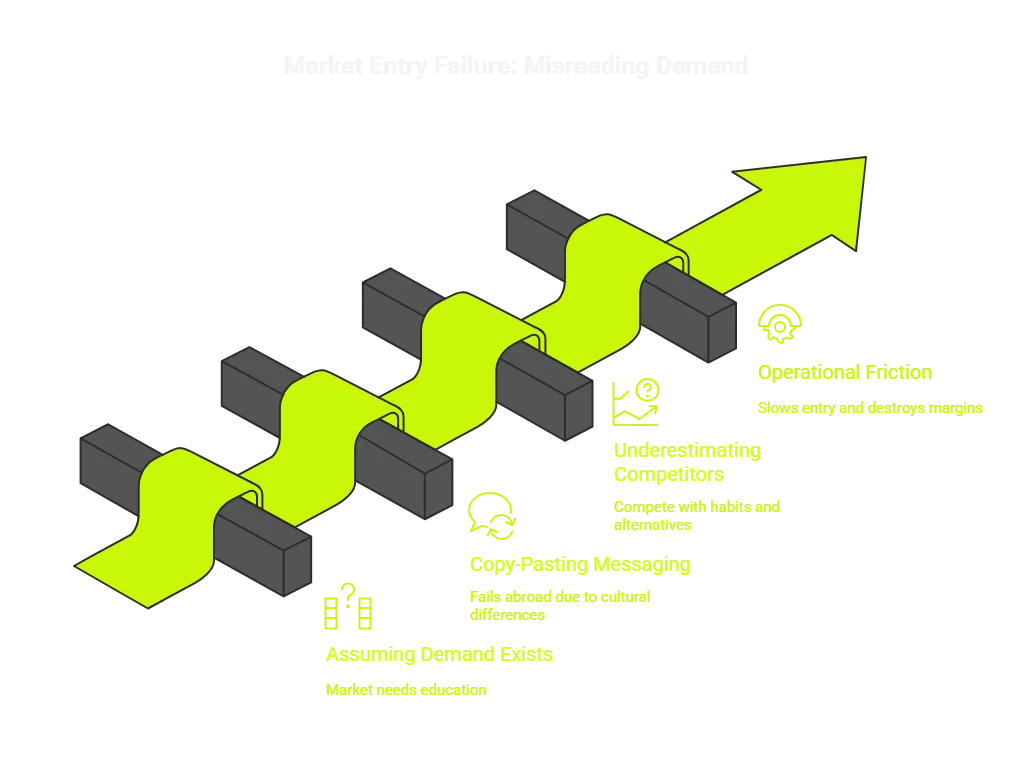

Most failed expansions don’t fail because the product is weak. They fail because the company misreads how demand is created in the new market.

- Assuming demand exists (when the market needs education)

If buyers don’t recognize the problem you solve — or don’t trust a new entrant — demand stays theoretical. You need education, proof, and a clear reason to switch.

- Copy-pasting messaging across markets

What works at home often fails abroad because motivations, objections, and cultural “decision language” change. Local buyers may require different proof, comparisons, and framing.

- Underestimating competitors and substitutes

You don’t just compete with similar brands. You compete with habits, local defaults, informal alternatives, and “doing nothing.” Winning often means making switching feel safe and obvious.

- Treating operational friction as an afterthought

Certifications, data rules, distribution constraints, service expectations, returns, and partner dependencies can slow entry or quietly destroy margins. Market entry requires commercial realism.

The pattern is consistent: companies launch too early, spend too broadly, and learn too slowly. Global investment conditions are becoming more fragmented and less predictable, which is why structured market entry and investment facilitation are increasingly important, as highlighted in UNCTAD’s World Investment Report 2024.

A Practical Market Entry Framework (Strategy → Execution)

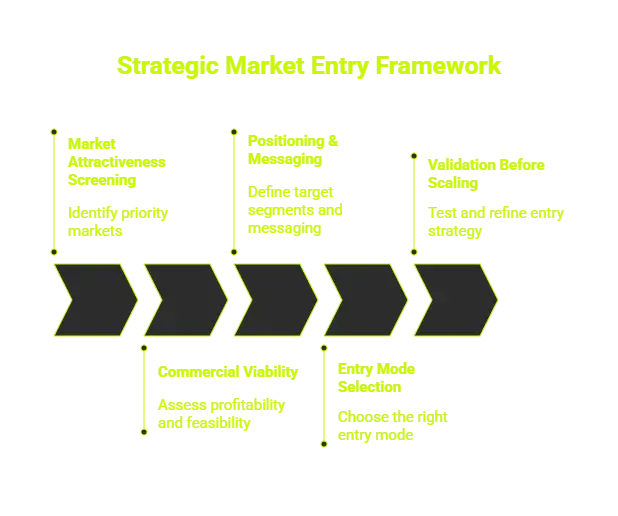

We prefer frameworks that are both structured and usable. Here’s a practical process Stratika uses to reduce risk and accelerate traction.

Step 1: Market Attractiveness Screening (Should We Even Go There?)

Goal: identify markets worth deeper investment.

We look at:

Demand signals and early intent

Competitor intensity and differentiation gaps

Channel accessibility (search, marketplaces, partners)

Price expectations and purchasing behavior

Operational/regulatory friction (where relevant)

Output: a shortlist of 1–3 priority markets, not a long “maybe” list.

Step 2: Commercial Viability (Can We Win Profitably?)

Market size doesn’t pay bills — margins do.

We pressure-test:

Customer acquisition economics (CAC reality)

cost structure and margin durability

Payback period and cash-flow timing

Operational feasibility and service expectations

Output: a go/no-go and a realistic 90-day entry plan.

Step 3: Positioning & Messaging (Why Will Local Buyers Choose You?)

This is where marketing-led market entry becomes powerful.

We define:

Target segments that actually buy

The “job to be done” locally

The real alternatives (including habits)

Proof and credibility signals that reduce perceived risk

Output: positioning, core messaging, landing page structure, and content angles.

Step 4: Entry Mode Selection (How do we enter with the proper control?)

Entry can be:

Direct export

Distributor-led

Partnerships

Digital-first

Hybrid models

Each mode changes speed, control, risk exposure, and marketing investment. We choose the mode that fits your capabilities and the market reality.

Output: entry mode + channel strategy + responsibilities.

Step 5: Validation Before Scaling (Prove it before you go big)

This is where market entry services save money and time.

We run controlled validation through:

Pilot launches

Targeted campaigns

Messaging tests

Segment testing

Regional rollouts

Output: evidence-based scaling plan (what to double down on, what to stop).

What Stratika’s Market Entry Services Include

Who We Work With

Stratika Solutions supports ambitious brands across food and beverage, retail, health technology, education, and consumer products as they expand into new markets. Our experience includes working with a Brazilian perfumery, a Beirut textile art studio, Colombian coffee brands, a European bakery and café chain, a South African e-learning platform, a Swiss diabetes application, a Hungarian frozen foods brand, a cherry liqueur bar concept, and coffee chains operating in Romania and Ukraine. What these clients have in common is not their industry. It is their ambition to grow beyond their home market and their need for a structured, commercially sound path to international expansion.

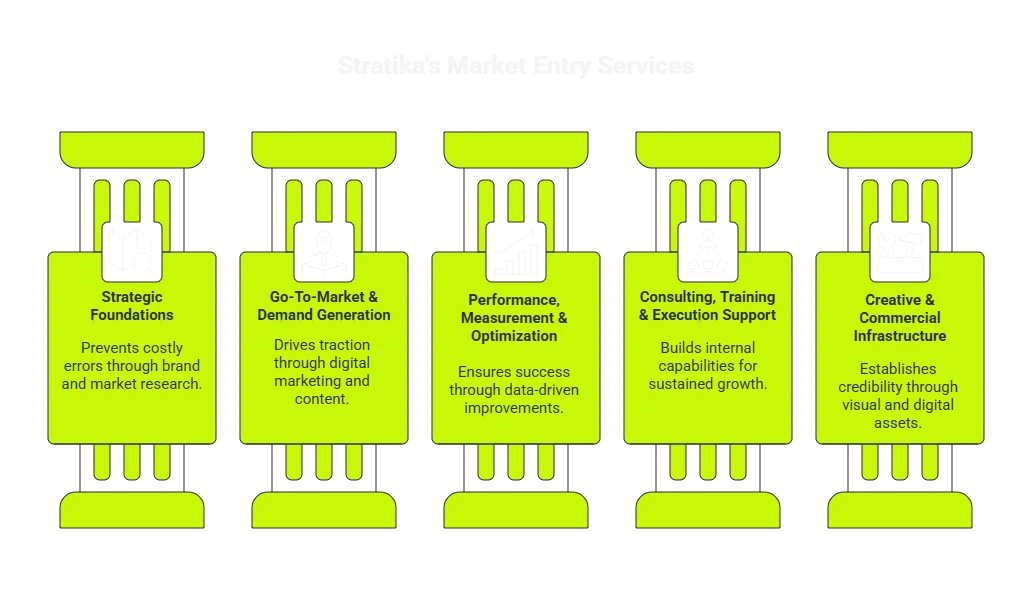

Stratika Solutions supports market entry end-to-end. Not as disconnected services, but as an integrated system designed to create demand and scale with control.

1) Strategic Foundations

This phase prevents expensive mistakes.

Brand Discovery & Audit

We clarify what you stand for, what’s confusing, what’s commoditized, and what creates trust in new markets.

Market & Competitor Research

We map competitor positioning, channel presence, pricing patterns, proof strategies, and the “unspoken rules” of the category.

Audience Persona Development

We define buyer segments based on real behavior, including motivations, objections, triggers, decision-making processes, and trust requirements.

Brand Positioning & Messaging

We build a clear “why us,” differentiated narrative, and messaging system adapted to the target market’s decision logic.

Naming & Tagline Creation (when needed)

For new markets or offers where clarity and memorability are crucial.

Visual Identity & Brand Guidelines (when needed)

So you look credible immediately — especially in premium or trust-sensitive categories.

2) Go-To-Market & Demand Generation

This is how strategy becomes traction.

Website Design & Development

We build landing pages and flows that align with the entry narrative and drive conversions.

Search Engine Optimization (SEO)

We structure category pages, cluster content, and localization so buyers can find you the way they actually search.

Pay-Per-Click (PPC) Advertising

We run controlled tests to validate segments and messaging fast, then scale what performs.

Social Media Marketing & Management

We build credibility and demand where your buyers spend attention.

Email Marketing Campaigns

We nurture leads and support longer decision cycles (especially B2B).

Content Marketing

We create market education assets and proof-driven content that reduces friction and builds authority.

Influencer & Affiliate Strategies

When borrowing trust and distribution accelerate early adoption.

3) Performance, Measurement & Optimization

Launching is not winning. Performance is.

Comprehensive Marketing Plan Development

One comprehensive operating plan that links goals, channels, budgets, timelines, and KPIs.

Campaign Planning & Execution

Consistent cadence, clear testing logic, and fast learning loops.

Analytics & Reporting

Dashboards and reporting tied to decisions, not vanity metrics.

Conversion Rate Optimization (CRO)

We fix leaks and increase conversion before simply buying more traffic.

Customer Journey Mapping

We align marketing and sales to the real buyer journey in the new market.

4) Consulting, Training & Execution Support

Some teams want delivery. Others want to build capabilities too.

Market Entry Strategy Consulting

Structured decision-making, risk management, and action plans.

Workshops & Training Sessions

Enable your internal team to execute consistently and independently over time.

Brand Audits & Evaluations

Ongoing clarity and alignment across markets.

Customer Experience Optimization

We refine onboarding, service flows, and retention drivers that turn early traction into durable growth.

5) Creative & Commercial Infrastructure

This is where most expansions quietly fail — because execution looks “almost right” but doesn’t build trust.

Graphic Design (Digital & Print), Video, Motion, Packaging, Print

Credible assets that match the market’s quality expectations.

E-commerce Platform Development

When digital-first entry is the right route.

Sales Funnel Optimization

Landing pages, offers, lead magnets, and follow-ups that convert.

CRM & Lead Management Systems

Pipeline clarity, segmentation, automation, and handoff between marketing and sales.

Lead Generation Strategies

Outbound + inbound systems designed for your market and sales cycle.

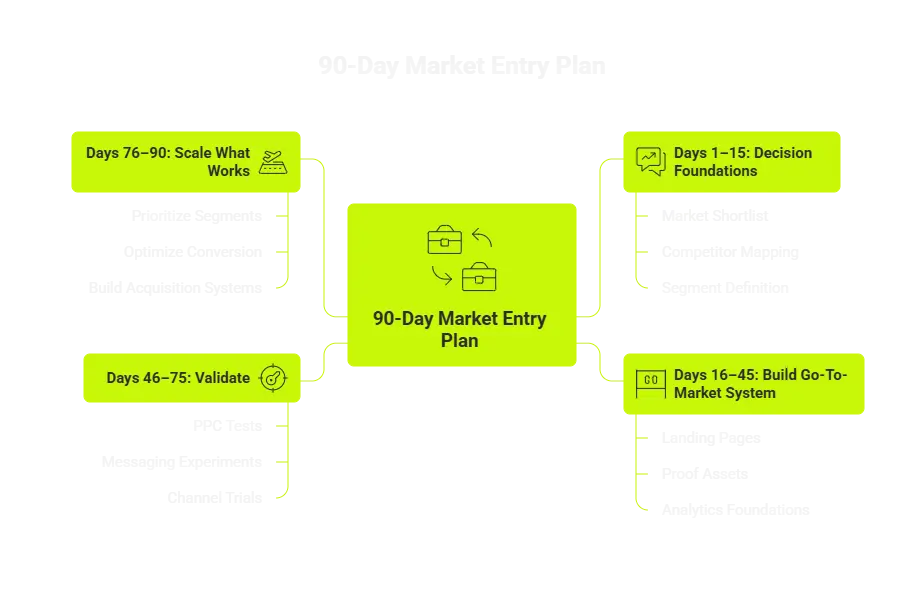

A Practical 90-Day Market Entry Plan (How “Good” Looks)

Days 1–15: Decision Foundations

Market shortlist + entry hypothesis

Competitor and channel mapping

Segment definition + initial positioning

Days 16–45: Build the Go-To-Market System

Landing pages + messaging system

Proof assets + content angles

Analytics, tracking, CRM foundations

Days 46–75: Validate

Controlled PPC tests

Messaging and segment experiments

Channel trials and early partner exploration

Days 76–90: Scale What Works

Prioritize winning segments/channels

Optimize conversion leaks

Build repeatable acquisition systems

This is the difference between “launching” and entering a market.

Who Market Entry Services Are For

Market entry services make the biggest difference when:

You’re entering a market where you have low brand awareness

Local competitors are strong, or buyers are skeptical

You have limited internal research or growth capacity

Mistakes are expensive (compliance, logistics, premium positioning)

Speed matters, but control matters more

How Stratika Solutions Supports Market Entry

Stratika Solutions delivers market entry services as a connected system:

Market assessment and prioritization

Positioning, messaging, and credibility building

Go-to-market planning and execution

Demand generation across channels

Performance measurement and optimization

Scaling with repeatable processes

This is not a collection of disconnected tactics. It is a commercial engine designed to help companies enter new markets with clarity, control, and momentum. If you want your expansion to be driven by real demand rather than assumptions, we help you structure the right strategy, validate it with live data, and execute it with precision. That is how market entry becomes a predictable growth channel, rather than a risky experiment.

![Market Entry Services: From Strategy to Scalable Growth [2026 Edition]](https://stratikasolutions.com/wp-content/uploads/2025/06/Market-Entry-Services-Cover-by-Startika-Solutions-1170x547.png)