Market Entry

Market Entry: How Southeast Asian Companies Successfully Expand Into New Markets [2026]

Expanding into new markets is one of the most critical growth decisions a company can make. For many Southeast Asian businesses, international expansion presents both significant opportunities and material risks. While the potential for new revenue streams and increased global visibility is attractive, market entry is rarely straightforward and often requires informed decision-making supported by experienced consulting insight.

Successful market entry demands far more than exporting a product or launching a translated website. It requires structured thinking, a deep understanding of demand, and a marketing-driven approach guided by market entry consulting that aligns strategy with execution. This guide explains what market entry truly entails, why it often fails, and how Southeast Asian companies can approach expansion in a disciplined, data-informed, and commercially viable manner.

What Market Entry Really Means for Growing Companies

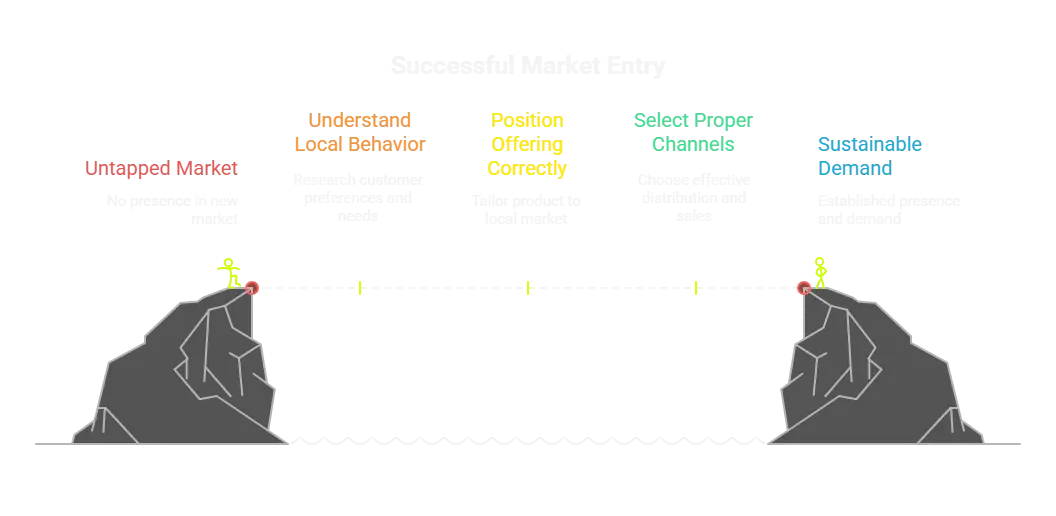

Market entry is the structured process of introducing a product or service into a new geographic or commercial market and establishing sustainable demand. It is not simply about selling abroad. It involves understanding local customer behavior, positioning the offering correctly, selecting the proper channels, and building trust in unfamiliar environments.

For growing companies, market entry should be viewed as a strategic growth initiative rather than an operational task. Marketing plays a central role because demand validation, positioning, messaging, and channel selection are critical success factors in any expansion effort.

Why Market Entry Fails Even When the Product Is Strong

Many companies approach international expansion with confidence in their product, but underestimate the complexity of new markets. Without a clear brand strategy and a well-defined brand identity adapted to local expectations, even a strong product may fail to gain traction and achieve sustainable growth.

-

Assuming Demand Exists Without Market Education

In many cases, target customers are not familiar with the problem the product solves or do not yet recognize its value. Without proper market education and clear positioning, demand remains theoretical rather than commercial. Research and our experience consistently show that around 60 percent of small and medium-sized companies face serious challenges during international expansion, most commonly due to an insufficient understanding of local customer behavior and ineffective adaptation of marketing strategies, which directly limit demand creation in new markets.

- Using Identical Messaging Across Markets

Buyer motivations, decision-making processes, and cultural expectations vary significantly between markets. Messaging that performs well domestically may fail to resonate internationally if it is not adapted to the local context. As part of an effective market entry process, creative strategy and localized creative execution play a critical role in translating brand value into culturally relevant communication. Industry research consistently shows that more than 70 percent of consumers are more likely to engage with and trust brands that communicate in a way that reflects their local language and cultural norms, highlighting the commercial risk of relying on standardized messaging across different markets.

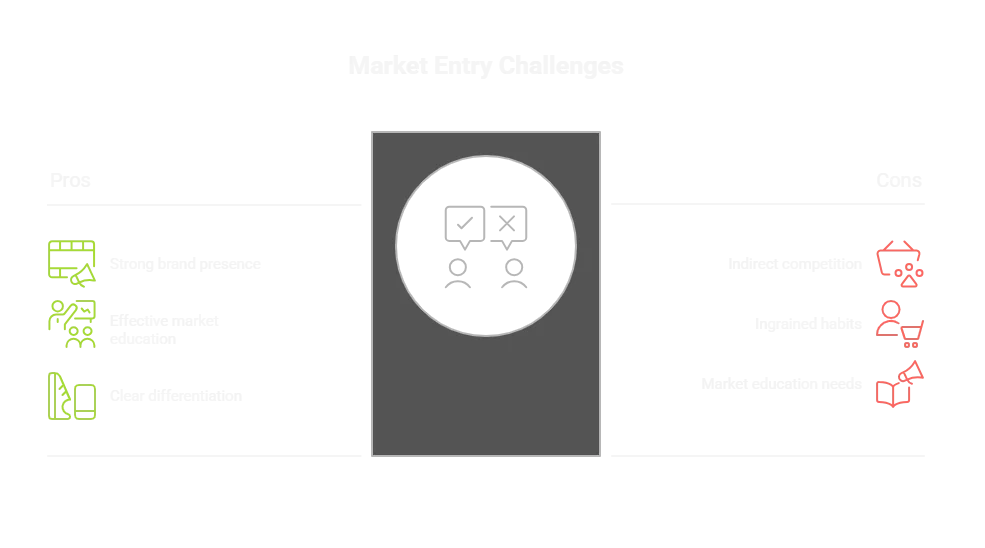

- Overlooking Competitive and Substitute Solutions

Competition is not limited to direct alternatives; it also encompasses indirect alternatives. Local solutions, informal substitutes, and deeply established customer habits often compete for the same attention and budget. Market research repeatedly shows that more than half of purchasing decisions are influenced by existing habits and familiar solutions. This means that new entrants frequently compete not only with other brands but also with ingrained behaviors that are difficult to displace without clear differentiation and strong market education.

- Underestimating Regulatory and Operational Complexity

Legal requirements, certifications, data regulations, and distribution structures vary significantly across regions. A lack of preparation in these areas can delay market entry or substantially increase costs. Industry analyses indicate that regulatory and compliance-related issues are among the top three causes of delayed international market launches, often adding months to timelines and increasing initial expansion budgets well beyond original projections.

Market Entry as a Marketing Led Growth Decision

Market entry must be driven by verified demand rather than assumptions, as an ineffective marketing strategy is one of the primary reasons otherwise strong products fail in new markets. Marketing strategy plays a vital role in identifying demand signals, testing value propositions, and mapping the buyer journey before significant resources are committed. Without a clear and well-executed marketing strategy, even high-quality products struggle to achieve widespread adoption. In contrast, companies that validate markets through structured marketing insights significantly reduce risk and improve the likelihood of successful expansion by shifting decisions from intuition-driven judgment to data-informed execution.

Market Entry Frameworks From Theory to Execution

Strategic frameworks are designed to support informed decision-making and bring structure to complex market entry decisions. When applied correctly, they enable companies to objectively compare strategic options, assess relative risk and opportunity, and prioritize target markets based on clear commercial criteria rather than assumption or intuition.

- Why Market Entry Frameworks Matter

Frameworks provide structure to complex decisions by translating uncertainty into clear evaluation criteria. They enable leadership teams to assess risk, measure market attractiveness, and align internal stakeholders around shared assumptions and priorities, creating a more disciplined and transparent decision-making process.

- When Classical Frameworks Are Useful and When They Are Not

Well-known models, such as industry analysis frameworks or portfolio matrices, are valuable reference tools for strategic decision-making. However, they were originally developed for large enterprises with significant research resources and long planning horizons. For small and medium-sized companies, simplified and practical frameworks are often more effective, enabling faster decisions, focused analysis, and more efficient use of limited resources.

A Practical Market Entry Process From a Consulting Perspective

An effective market entry process strikes a balance between strategic rigor and commercial realism. From a consulting perspective, the objective is not only to identify opportunities but to ensure that expansion decisions are grounded in demand, profitability, and operational feasibility.

- Market Attractiveness Screening

The first step is determining whether a market warrants further investment. This assessment focuses on demand indicators, market growth potential, and competitive intensity. Digital signals, such as search behavior, online engagement, and early interest patterns, often provide valuable insights into whether demand exists and how competitive the landscape may be.

- Commercial Viability Assessment

Market attractiveness alone does not ensure commercial success. Pricing expectations, cost structures, and margin sustainability must be evaluated to confirm that the opportunity is financially viable. This step helps companies avoid entering markets that appear promising but fail to deliver acceptable returns over time.

- Entry Mode Selection

Companies can pursue market entry through multiple approaches, including direct export, distributor relationships, strategic partnerships, or digital-first models. Each entry mode carries different implications for speed, level of control, risk exposure, and required marketing investment. Selecting the right approach is critical to aligning strategy with internal capabilities and market conditions.

- Validation Before Scaling

Before committing significant resources, assumptions should be tested through pilot launches, targeted marketing campaigns, or limited regional rollouts. Early validation allows companies to refine positioning, messaging, and channel strategy while minimizing risk. This step is essential to ensuring that scaling decisions are based on evidence rather than expectation.

Market Entry Options and Their Marketing Implications

| Entry Mode | Marketing Effort | Speed to Demand | Level of Control | Typical Use Case |

|---|---|---|---|---|

| Direct Export | Moderate | Moderate | High | Initial market validation |

| Distributor | Low to Moderate | Fast | Low | Rapid market presence |

| Partnership | Moderate | Moderate | Shared | Complex regulatory markets |

| Digital First | High | Fast | High | Service and direct-to-consumer models |

Each entry mode requires a tailored marketing approach aligned with its risk and control profile.

Market Entry Case Examples Through a Marketing and Consulting Lens

- Case Example: When Marketing Was Underestimated

A Southeast Asian technology company selected a large international market primarily based on market size and language compatibility. From an operational standpoint, the decision appeared sound, and the product itself was competitive. However, limited investment in market education and an unclear positioning strategy resulted in weak initial traction. Customer acquisition costs were significantly higher than projected, while adoption rates remained slow.

The key takeaway was that market size and surface-level compatibility alone do not ensure commercial success. Without a clearly defined marketing strategy that builds awareness, communicates value, and guides demand creation, even strong products can struggle to gain momentum in new markets.

- Case Example of a Marketing Led Market Entry

In contrast, a consumer brand approached international expansion through a structured demand validation process. Before committing to full-scale entry, the company tested multiple messaging angles across clearly defined customer segments, refined its value proposition based on performance data, and evaluated channel effectiveness. Local distribution partnerships were established only after early traction had been confirmed.

This phased, marketing-led approach allowed the brand to enter the market with greater confidence, control investment risk, and scale growth progressively. As a result, the company achieved stronger market adoption and improved long-term profitability.

Market Entry for Small and Medium Companies Versus Large Enterprises

-

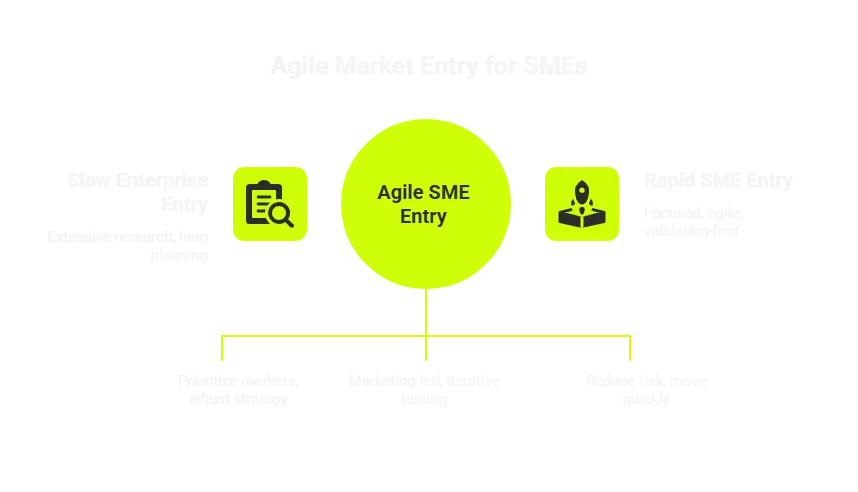

How Large Enterprises Typically Enter Markets

Large enterprises usually approach market entry through extensive research, long planning cycles, and portfolio-level strategies. Decisions are often made at a corporate level, with multiple markets evaluated in parallel and expansion aligned with long-term strategic objectives. Their scale allows them to absorb early inefficiencies and longer time to market, supported by strong brand equity and access to capital.

This structured approach is effective for large organizations, but it relies on resources, timelines, and risk tolerance that are rarely available to smaller companies. A deeper look at enterprise market entry models and portfolio-based expansion strategies will be explored in a separate article.

-

How Small and Medium Companies Should Approach Market Entry

Small and medium-sized companies require a more focused and agile approach to market entry. Rather than lengthy upfront analysis, success is driven by faster decision-making, marketing-led demand validation, and iterative testing. Limited resources make it essential to prioritize the right markets early and adjust strategy based on real market feedback. This agile, validation-first mindset enables SMEs to reduce risk while moving quickly. In future articles, we will explore practical market entry strategies for SMEs, including marketing-driven validation frameworks and phased expansion models.

-

When Market Entry Requires Consulting Support

Certain expansion scenarios introduce elevated risk. These include multi-market selection, high regulatory exposure, significant upfront investment, or limited internal strategy capacity. In such cases, consulting support provides structure, accelerates decision-making, and mitigates costly errors.

How Stratica Solutions Supports Market Entry

Stratica Solutions supports companies at every stage of market entry through a structured combination of market entry consulting and international marketing strategy. Our approach begins with a market assessment and opportunity prioritization, ensuring that expansion decisions are grounded in verified demand and commercial viability, rather than assumptions. We then define a clear positioning strategy and brand narrative tailored to local market dynamics, followed by go-to-market planning that aligns channels, messaging, and execution with strategic objectives. Where required, we also provide execution support, enabling companies to test, validate, and scale their market entry with confidence while maintaining strategic control and minimizing risk.

Final Thoughts: Market Entry as a Growth System

Market entry does not fail because products are weak. It fails because companies rely on assumptions instead of a structured approach, underestimate demand creation, and enter new markets without a disciplined strategy. When marketing, validation, and execution are treated as secondary considerations, expansion quickly turns into rising costs, slow adoption, and stalled growth. A consulting-led market entry approach eliminates this uncertainty. By applying proven frameworks, market intelligence, and marketing strategy from the outset, companies replace guesswork with control, shorten time to traction, and significantly increase the probability of success. This is the difference between hoping a market will work and knowing it will.

![Market Entry: How Southeast Asian Companies Successfully Expand Into New Markets [2026]](https://stratikasolutions.com/wp-content/uploads/2025/06/South-East-Asia-Globe-market-entry-Stratika-Solutions-Blog-1-1170x547.webp)